THE CANADA REPORT

Canada’s Economic Suicide: How a Drama Teacher, a Dropout, and a Globalist Set the Table for Collapse

Writing this post has been difficult, as it reflects hard truths in what may be our most challenging economic period since the Depression and wartime years.

“You can avoid reality, but you cannot avoid the consequences of avoiding reality.” Ayn Rand

Since Confederation, Canada has grappled with the economic dominance of its southern neighbor. After WWII, as British influence waned, the U.S. shaped Canada’s industrial growth into a branch-plant economy. While this fostered wealth, infrastructure, and a skilled managerial class, Canada remained sheltered behind a tariff wall.

From 1945 to NAFTA (1994), tariffs protected domestic industries but also raised consumer costs, as businesses passed the burden onto Canadians. Trade liberalization began with the Auto Pact (1965), accelerating through the 1989 Canada-U.S. Free Trade Agreement and culminating in NAFTA, which fully integrated the two economies. By NAFTA’s enactment, most U.S. tariffs had already been eliminated, leaving only global trade barriers under Canada’s General Tariff system.

Every challenge presents an opportunity, but the course taken by our current leaders—both federally and provincially—does nothing more than delay the inevitable. At best, their approach kicks the problem further down the road, leaving Canada increasingly vulnerable until the next U.S. administration decides to strong-arm us into becoming the 51st state.

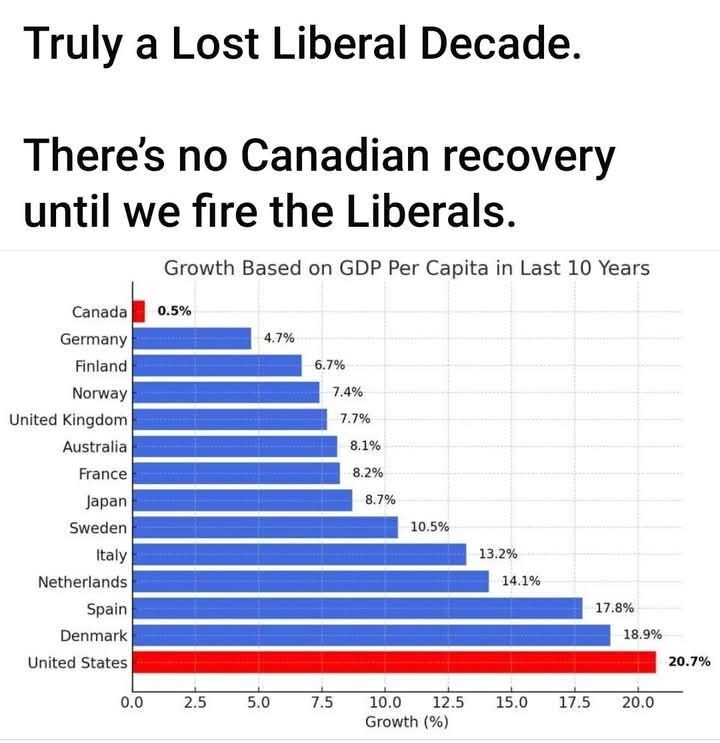

The past decade under the Liberal government has left our economy exposed and weakened. Not only has Canada failed to attract investment capital to leverage its vast energy resources, but the Prime Minister actively discouraged critical LNG projects sought by Germany and Japan. In total, three major LNG initiatives—representing over $70 billion in potential investment—were lost due to the policies of this government.

Yet, that is merely the tip of the iceberg. A fact rarely acknowledged by the so-called financial media is that between 2016 and 2024, more than $1 trillion in investment capital fled Canada, as noted by renowned economist David Rosenberg. This exodus represents far more than just lost dollars; it signifies the departure of mature capital, established businesses, and top-tier talent—elements essential for fostering innovation, productivity, and long-term economic growth. The consequences are far-reaching: fewer high-quality jobs, diminished consumer spending, and a decline in family formation, all of which are vital to a thriving economy.

Rather than addressing these systemic failures, the Prime Minister and Premiers resort to political theater, distracting the public with retaliatory tariffs. Their response reveals not only a lack of strategic foresight but also an absence of creativity or bold, out-of-the-box thinking. Their strategy appears to be little more than posturing—hoping that by making minor concessions, such as reversing the 25% electricity tariff, they can placate Trump and avoid the hard choices that real leadership demands.

Canada is currently engaged in an economic war, yet we continue to show up to the battlefield armed with little more than a butter knife while our primary adversary, the United States, wields heavy artillery. It is time to change the approach, abandon passive strategies, and adopt an aggressive, forward-thinking economic policy that prioritizes Canadian interests.

1. Corporate Tax Reform: The Irish Model

When President Trump cut the U.S. corporate tax rate from 35% to 21% in his first term, Canada did nothing. The combined corporate tax rate in Canada remained at 26.5%, making us less attractive for investment and contributing to a massive outflow of capital. The response? Canada should immediately cut corporate tax rates below 10%—not just match the U.S., but undercut it decisively. Additionally, new businesses moving to or being established in Canada should receive a five-year tax-free holiday. The second phase, years six to ten, should phase into a permanent 0% corporate tax rate, creating an investment haven akin to Ireland’s "Celtic Tiger" era, which transformed Ireland from an economic backwater into one of the world’s wealthiest per capita nations.

2. Strategic Export Tariffs: Make America Pay

Instead of engaging in self-destructive tariff wars which make Canadians bear the cost, Canada should strategically impose export taxes on all critical goods and materials heading south—electricity, rare earth minerals, metals, ores, and other essential commodities. The U.S. has long taken advantage of our resources at a discount, often using trade disputes to push down Canadian prices. Now it’s time to make them pay. This would mirror the U.S. approach to Mexico when Trump unilaterally imposed tariffs and claimed Mexico would pay for the border wall. If America wants our resources, they should compensate us fairly.

3. End the Oil Discount & Expand Global Market Access

For decades, Canada has sold its oil to the U.S. at a significant discount due to infrastructure limitations and market constraints. This must end. Canada should immediately move to align its oil prices with global market rates. The U.S. refineries, particularly along the Gulf Coast, are optimized to process Canada’s heavy crude, meaning they MUST buy from us in the short term. However, recognizing that they can adapt over time, Canada must also expedite the construction of pipelines to the Atlantic and Pacific coasts, securing new markets in Asia and Europe. Expanding global export capacity will ensure that Canadian oil is no longer shackled to U.S. interests and price manipulation.

4. The Bigger Picture: National Economic Sovereignty

This is not merely about trade policy; it is about Canada’s economic independence and national sovereignty. If we fail to act, we will slide into a state of total dependency on the U.S., effectively becoming an economic vassal state. The consequences? A per capita GDP potentially lower than that of Mississippi, a dwindling middle class, and a nation where home ownership is but a distant dream for most citizens.

The fight will not be easy. It will demand sacrifices, political will, and a willingness to disrupt entrenched economic structures. However, if we aspire to a future where Canadians can afford to raise a family in a home they own—where our economic fate is determined in Ottawa rather than Washington or Brussels—then the time to fight is now.

Canada must stand firm against U.S. economic dominance and reject the influence of globalist forces that seek to erode our economic self-sufficiency. We must ensure that our Bedford Falls does not become another U.S. Pottersville.