From an MoA commenter - by Jeffrey Wernick, the owner of Bitchute https://x.com/thewernickfiles/status/2015174501772808457?s=20

"The dollar's reserve status is an exorbitant privilege. It lowers our borrowing costs, expands our fiscal room, and lets us export risk and import goods on uniquely favorable terms. But privileges are not entitlements. They are conditional. And they come with responsibilities.

A reserve currency must satisfy three conditions. Liquidity, stability, and neutrality. The United States has always provided the first two. The third was assumed. It is no longer assumed.

A reserve currency is not just national money. It is global infrastructure. It functions like a public utility for settlement, collateral, and reserves. The responsibility is not "be nice." The responsibility is to keep the system credible as neutral plumbing. Predictable rules. Stable access. Property rights that are not contingent on politics. If the world is going to hold your liabilities as its safety buffer, you cannot treat those liabilities as a lever of coercion.

Weaponizing the dollar breaks that bargain. It turns the reserve asset into conditional permission. It reclassifies the dollar from risk-free to conditionally risk-free. The market reprices accordingly.

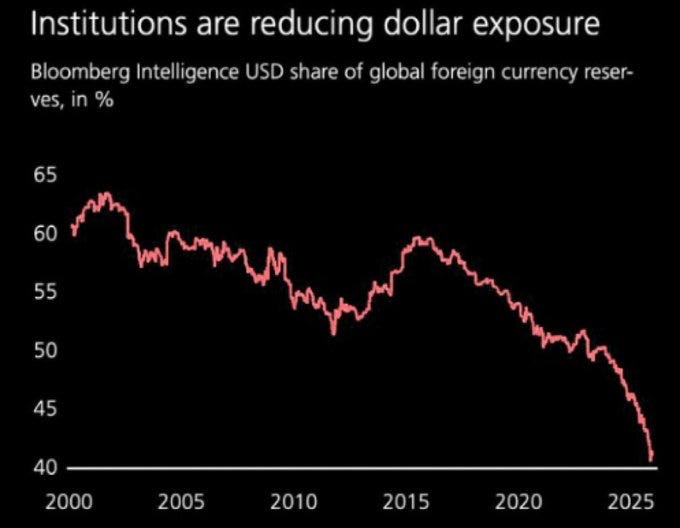

This is a policy with concentrated short-term benefits and diffuse long-term costs. The benefits accrue to whoever is in office when the sanctions are imposed. The costs accrue to everyone who holds dollars afterward. Naturally, the benefits are overweighted and the costs are ignored. Credibility is spent to purchase momentary advantage. The chart shows the price.

Every central bank learns the same lesson. If access depends on compliance, then holding dollars is not just a financial decision. It is a geopolitical exposure. So reserve managers do what rational actors do when an insurance policy starts behaving like a weapon. They diversify. This is not a policy choice. It is a portfolio adjustment to a change in the risk characteristics of the asset.

This is why global trade can keep settling in dollars while dollar reserves fall. Transactions follow network effects and liquidity. Reserves follow trust. Transactions can be coerced in the short run because there is no alternative settlement mechanism with comparable depth and liquidity. Reserves cannot be coerced because the holder chooses them in advance and can substitute. Reserves are held for crisis, and in a crisis you discover whether the asset you hold can be frozen, seized, or sanctioned out of reach.

The consequence is visible in the data. According to Bloomberg Intelligence, the dollar's share of global foreign currency reserves has fallen from roughly 65% to around 40% over twenty-five years, with the decline accelerating sharply since 2022. This is not gradual erosion. It is accelerating diversification. At this pace, it starts to look like exit. And the more the privilege is abused, the less anyone believes it is infrastructure.

None of this is new. The economists who built and studied the postwar system saw it coming.

Keynes foresaw the conflict of interest. At Bretton Woods he proposed the bancor, a supranational reserve currency controlled by no single nation, designed to eliminate the temptation inherent in a national currency serving as global reserve. The issuing nation would eventually abuse the privilege because the incentives were irresistible. The Americans rejected the bancor. They wanted the privilege.

Triffin identified the structural trap. In 1960 he observed that to supply global liquidity, the reserve issuer must run persistent deficits. But persistent deficits accumulate liabilities that eventually undermine confidence. The privilege is self-liquidating. The reserve issuer must choose between starving the world of liquidity or drowning itself in debt. Either way, the system breaks. Triffin predicted the collapse of Bretton Woods. Nixon closed the gold window eleven years later.

Rueff saw the moral hazard. He called the dollar system "the monetary sin of the West" and advised de Gaulle to convert French reserves to gold. He understood that a system dependent on one nation's discipline would fail when that nation lacked discipline. De Gaulle demanded gold. The drain accelerated. Nixon could have defended convertibility through painful discipline. He chose to close the window instead. Rueff was right. The discipline would not hold.

Keynes warned about the temptation. Triffin warned about the structure. Rueff warned about the inevitable failure of discipline. Weaponization confirms all three. It accelerates what was already structurally inevitable, proves the conflict of interest Keynes identified, and demonstrates the moral hazard Rueff named. One force is slow. The other is fast. The chart shows both. Gradual decay from 2000 to 2020, then a cliff.

There is no obvious floor. Some will argue that Treasury market depth and dollar liquidity impose one. But floors are behavioral, not structural. They hold until confidence breaks. And confidence is precisely what weaponization spends. The decline stops when the behavior stops, or when the diversification is complete.

The alternatives are already emerging. Bitcoin, gold, renminbi, bilateral arrangements that bypass the dollar entirely. Bitcoin first because it is the only one that cannot be frozen, seized, or sanctioned by any sovereign. That is not incidental to its appeal. The others are substitutes within the state system. Bitcoin is a substitute outside it.

Hayek identified the logic in 1976. In "Denationalisation of Money" he argued that monetary neutrality might require removing money from state control entirely. Private currencies should compete with government money because governments cannot resist the temptation to abuse monetary control. He did not foresee Bitcoin specifically, but he foresaw the principle. Forty years later, Satoshi implemented what Hayek theorized.

None of these alternatives is a perfect replacement for dollar liquidity. All are responses to the same lesson. A reserve asset that can be weaponized is not a reserve asset.

Settlement is a harder problem. Reserves can be diversified by individual decision. Settlement requires network infrastructure, liquidity, and counterparty adoption. The dollar's dominance in transactions is stickier than its dominance in reserves. But the market is working on settlement too. Slowly, unevenly, and with no single alternative yet capable of matching dollar scale. The point is that it is trying. The market can take the exorbitant privilege away. Not by decree, but by a thousand individual decisions to reduce exposure to an asset that has revealed itself as a tool of coercion.

And when reserve holders diversify, they are not likely to return. Trust is easier lost than earned.

The dollar's privilege was never a right. It was a franchise. Exorbitant privilege bought the United States extraordinary advantages. It also imposed an obligation to behave like a steward, not an owner. The world granted that privilege on trust. We are operating as if we own it. The market is reminding us that we rent it.

Weaponization spends it."